Minerva | Real-Time AML Risk Assessment Platform

🚀 Dive into the future of AML compliance with Minerva! This real-time risk assessment platform harnesses deep learning for faster investigations, fewer false positives, and cost-effective compliance programs. Stay ahead of financial crime effortlessly! 💼💡 #AI #AML #Fintech #Compliance

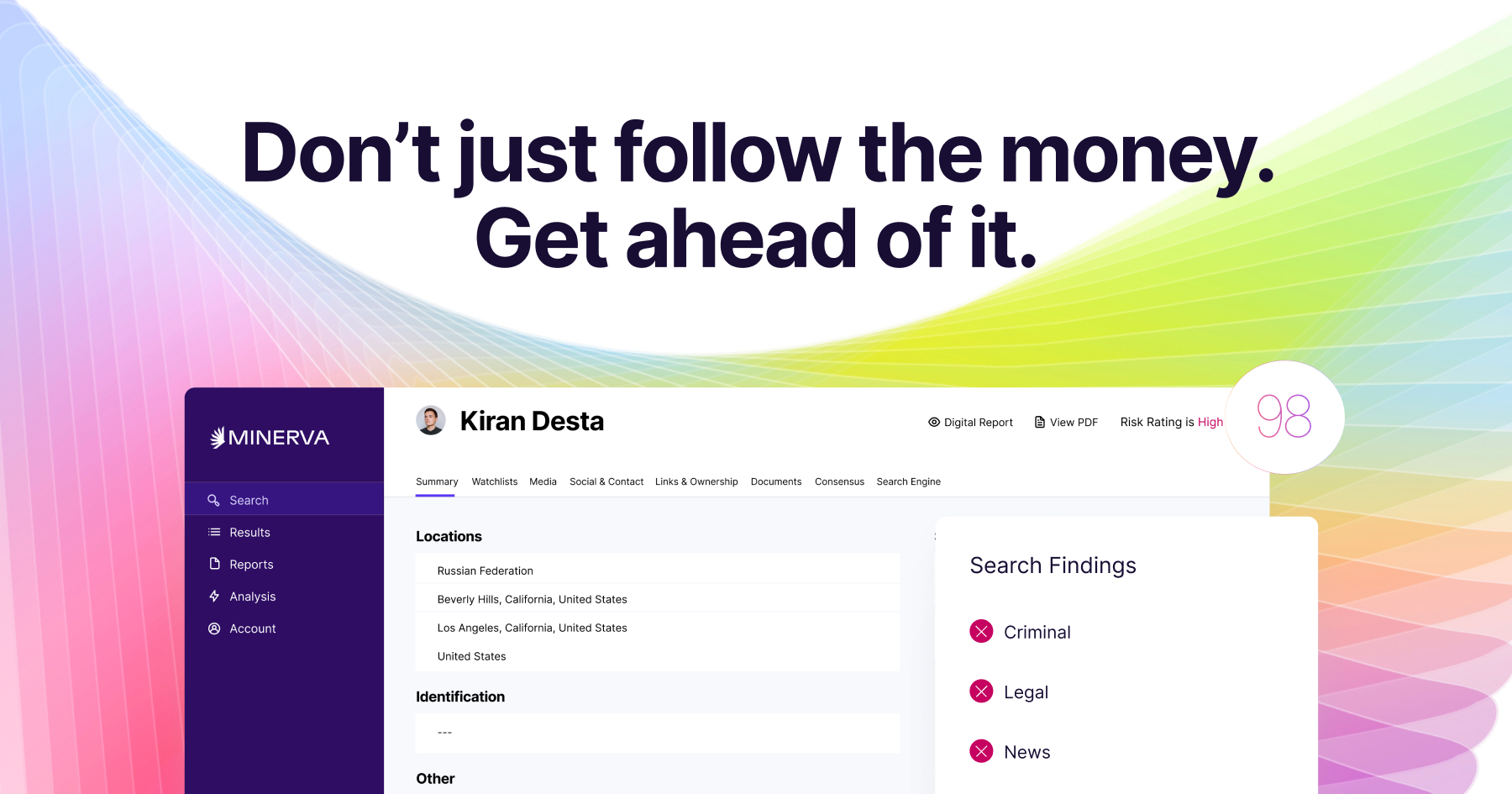

- Minerva is an AML risk assessment platform designed for real-time anti-money laundering capabilities at scale.

- It offers faster investigations, fewer false positives, and a cost-effective compliance program.

- The platform uses deep learning to deliver context-rich profiles, ensuring 15% fewer false positives compared to competitors.

- It covers IDV, KYC, KYB, beneficial ownership, sanctions screening, PEP & watchlists checks, investigations, EDD, adverse media checks, and ongoing monitoring.

- Minerva provides configurable risk ratings tailored to each organization's risk tolerance based on FATF guidance and industry standards.

- It enables users to see the complete risk picture by identifying relevant networks and relationships efficiently.

- The platform generates regulator-ready reports instantly, saving time on documentation and ensuring compliance.

- Minerva utilizes deep learning to access billions of verified data points in real time, enhancing entity resolution and contextual awareness.

- Trusted by top compliance leaders for automating AML obligations and enhancing due diligence capabilities efficiently.

- Minerva serves various industries including Financial Services, Crypto & Web3, Fintech, Payment Solutions, Gaming & Casinos, offering tailored solutions for each sector.

- The platform allows for efficient, effective investigations by leveraging comprehensive data analysis.

- Minerva offers demo bookings and contact options for further information.